Structure a Solid Financial Structure for College: Top Techniques for Smart Planning

As the expense of college remains to rise, it has actually become increasingly important for pupils and their family members to build a solid financial foundation for their greater education and learning. With appropriate planning and tactical decision-making, the desire for participating in college can become a truth without sinking in the red. In this discussion, we will discover the leading techniques for smart financial preparation for college, including establishing clear goals, understanding university costs, creating a spending plan and cost savings plan, discovering grants and scholarships, and taking into consideration trainee funding options. By implementing these approaches, you can pave the method for a financially safe and secure and successful university experience. Let's dive right into the globe of wise economic planning for university and uncover exactly how you can make your desires come true.

Setting Clear Financial Goals

Establishing clear economic objectives is a vital action in reliable financial planning for college. As trainees prepare to begin on their college trip, it is essential that they have a clear understanding of their monetary goals and the actions called for to attain them.

The very first facet of establishing clear financial goals is defining the cost of college. This involves researching the tuition fees, lodging costs, textbooks, and other miscellaneous costs. By having an extensive understanding of the economic demands, students can establish possible and reasonable objectives.

Once the expense of college has been identified, pupils need to establish a spending plan. This entails assessing their earnings, including scholarships, gives, part-time tasks, and adult payments, and after that alloting funds for necessary expenditures such as food, tuition, and housing. Developing a budget plan helps pupils prioritize their investing and makes certain that they are not spending beyond your means or building up unneeded debt.

Moreover, setting clear monetary objectives likewise includes recognizing the need for cost savings. Students ought to determine exactly how much they require to save every month to cover future expenses or emergencies. By establishing a cost savings goal, pupils can develop healthy and balanced financial routines and plan for unexpected conditions.

Understanding University Prices

Understanding these prices is crucial for efficient economic planning. It is vital for students and their family members to completely study and recognize these expenses to create a practical budget and monetary strategy for college. By recognizing the different elements of college prices, individuals can make educated choices and prevent unnecessary financial stress.

Producing a Budget and Financial Savings Strategy

Creating an extensive spending plan and financial savings plan is vital for effective economic planning throughout college. Beginning by noting all your resources of revenue, such as part-time work, scholarships, or economic aid. It requires regular tracking and modification to ensure your economic security throughout your university years.

Discovering Scholarships and Grants

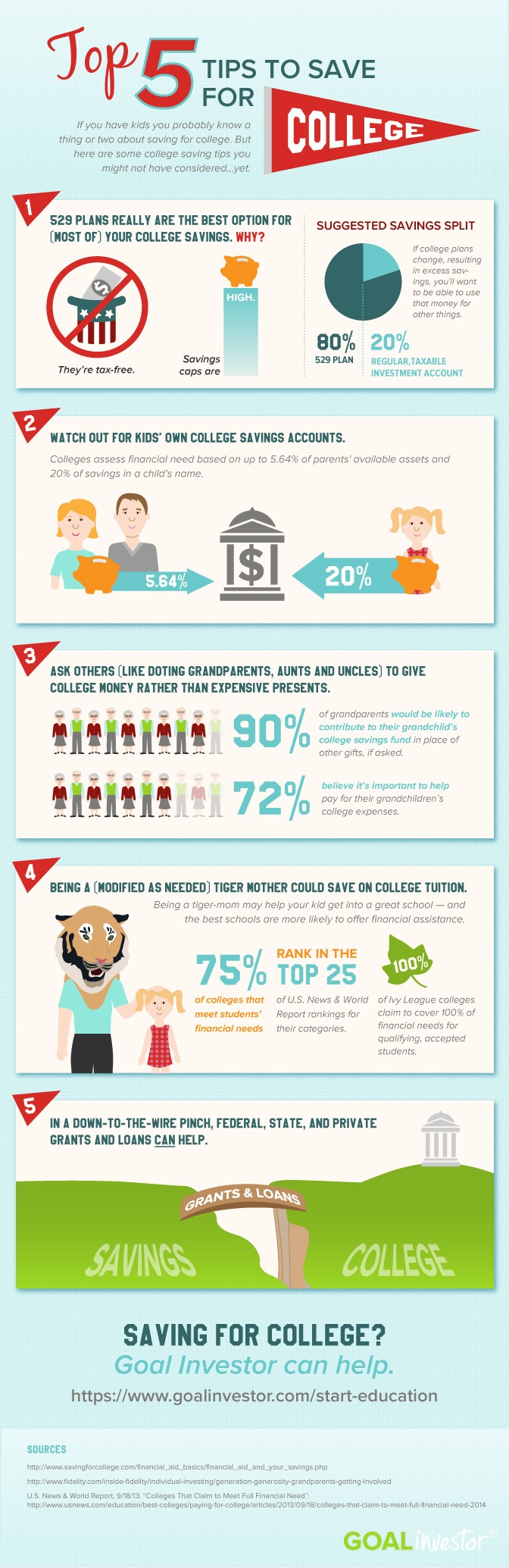

To optimize your funds for university, it is important to discover offered scholarships and grants. Save for College. Grants and scholarships are an excellent means to fund your education and learning without needing to rely heavily on lendings or individual cost savings. These financial assistances are usually granted based upon a range of variables, such as academic success, athletic efficiency, extracurricular involvement, or economic requirement

Begin by looking into gives and scholarships supplied by universities and colleges you are interested in. Several establishments have their own scholarship programs, which can offer considerable monetary aid.

When using for gives and scholarships, it is important to pay very close attention to due dates and application requirements. Many scholarships need a completed application type, an essay, recommendation letters, and our website transcripts. Save for College. Make certain to adhere to all directions very carefully and send your application ahead of the due date to enhance your chances of receiving funding

Checking Out Pupil Loan Options

When taking into consideration how to fund your college education and learning, it is essential to explore the different options readily available for student lendings. Pupil finances are a practical and common method for students to cover the expenses of their education and learning. Nevertheless, it is crucial to recognize the different sorts of student lendings and their terms prior to making a decision.

Another option is personal trainee fundings, which are supplied by banks, lending institution, and other exclusive loan providers. These financings typically have higher passion rates and more rigorous payment terms than federal fundings. If government financings do not cover the complete expense of tuition and other costs., exclusive financings might be required.

Verdict

To conclude, developing a strong financial structure for university calls for setting clear goals, recognizing the prices entailed, developing a budget plan and cost savings plan, and checking out scholarship and grant chances. It is crucial to consider all offered alternatives, consisting of student fundings, while lessening personal pronouns in a scholastic composing design. By following these approaches for wise preparation, pupils can browse the monetary aspects of college and lead the way for a successful academic trip.

As the expense of college proceeds to increase, it has come to be significantly crucial for students and their family members to develop a strong monetary foundation for their greater education. In this discussion, we will certainly check out the leading methods for wise financial preparation for college, consisting of setting clear objectives, comprehending college expenses, creating a spending plan and cost savings strategy, checking out scholarships and grants, and considering pupil finance options. It is vital for trainees and their family members to completely study and comprehend these prices to produce a practical budget plan from this source and economic plan for university. These financial aids are typically granted based on a selection of elements, such as scholastic achievement, athletic efficiency, extracurricular participation, or monetary demand.

By following these methods for clever planning, trainees can browse the economic aspects of college and lead the means for a successful academic trip.